Finance Your Dream Boat, Camper Trailer, or Jet Ski Without Breaking the Bank

Jan 09, 2025

Choosing between a fixed and variable rate loan is one of the most important decisions borrowers face when financing a car, boat, caravan, or other leisure asset. The rate structure you select directly affects your monthly repayments, total interest costs, and financial flexibility over the life of your loan.

Both options have distinct advantages depending on your financial situation, risk tolerance, and how long you plan to keep the asset. Understanding these differences helps borrowers make confident decisions that align with their budget and lifestyle goals. This guide breaks down both rate types, compares their benefits and drawbacks, and provides practical guidance for choosing the right structure for your next car finance or leisure finance purchase.

Overview

This article covers the fundamental differences between fixed and variable rate loans, explores the pros and cons of each option, examines real-world scenarios for car and leisure buyers, and provides a decision framework to help you choose. You will also find answers to frequently asked questions and guidance on getting the best rate for your circumstances.

Find The Best Deal

With over 10 years of industry experience we are a leading independent broker with a diverse panel of 40 + lenders to find you the best solution, tailored to you and your goals!

Key Takeaways

- Fixed rate loans lock in your interest rate for the loan term, providing predictable repayments regardless of market changes.

- Variable rate loans fluctuate with market conditions, potentially saving money when rates drop but increasing costs when rates rise.

- Fixed rates suit borrowers who prioritise budget certainty and protection against rate increases.

- Variable rates may benefit those who can absorb payment fluctuations and want flexibility features like extra repayments.

- Your choice should reflect your financial stability, risk tolerance, loan term, and current economic conditions.

What Is a Fixed Rate Loan?

A fixed rate loan locks your interest rate at the time of approval, meaning your repayments remain identical throughout the agreed fixed period—typically one to seven years for vehicle and leisure finance. This structure shields borrowers from market volatility and Reserve Bank of Australia (RBA) cash rate movements.

Fixed rate loans are particularly popular among buyers who value predictability. When you know exactly what you will pay each fortnight or month, budgeting becomes straightforward. This certainty proves especially valuable for families, first-time borrowers, or anyone financing a significant purchase like a new car or boat, camper trailer, or jet ski.

However, fixed rates often come with restrictions. Most fixed rate products limit or penalise extra repayments, and break costs may apply if you pay out the loan early. These trade-offs are worth considering if you anticipate changes to your financial situation during the loan term.

What Is a Variable Rate Loan?

A variable rate loan has an interest rate that moves up or down based on market conditions, typically influenced by the RBA cash rate and lender funding costs. When rates fall, your repayments decrease; when rates rise, your repayments increase accordingly.

Variable loans generally offer greater flexibility than their fixed counterparts. Most allow unlimited extra repayments without penalty, and some include redraw facilities that let you access additional funds you have paid in. This flexibility appeals to borrowers who may receive bonuses, tax refunds, or irregular income and want the option to pay down their loan faster.

The trade-off is uncertainty. Borrowers must be comfortable with the possibility that their repayments could increase, sometimes significantly, if interest rates rise. Understanding how interest rates impact your financing choices helps you prepare for this variability.

Fixed vs Variable: A Direct Comparison

Repayment Predictability

Fixed rate loans offer complete repayment certainty. Your monthly or fortnightly amount stays the same, making it simple to plan household budgets and manage cash flow. Variable loans require more active monitoring, as repayments can change with little notice following rate adjustments.

Flexibility and Extra Payments

Variable loans typically allow borrowers to make extra repayments without penalty, potentially shortening the loan term and reducing total interest paid. Fixed loans often cap additional payments or charge fees for exceeding limits. If paying off your loan early is a priority, this distinction matters significantly.

Early Payout and Break Costs

Exiting a fixed rate loan before the term ends may trigger break costs—fees designed to compensate the lender for lost interest revenue. These costs can be substantial depending on remaining term length and rate differentials. Variable loans rarely carry such penalties, offering more freedom to refinance or pay out the loan when circumstances change.

Interest Rate Risk

Fixed rates protect against increases but prevent you from benefiting if rates fall. Variable rates expose you to both upside and downside movements. Your comfort with financial uncertainty should guide this decision. Those exploring the impact of inflation on leisure finance will find this consideration particularly relevant in the current economic environment.

When Fixed Rates Make Sense

Fixed rate loans work best for borrowers who prioritise stability and want protection against rising interest rates. Consider a fixed rate if you have a tight household budget with little room for payment increases, are financing over a longer term where rate volatility has more time to affect costs, believe interest rates are likely to rise based on economic indicators, or simply prefer knowing exactly what you will pay each month.

First-time borrowers often benefit from fixed rates while they establish their financial footing. The predictability removes one variable from an already significant financial commitment. Before applying, reviewing a step-by-step guide to getting a car loan can help you prepare.

When Variable Rates Make Sense

Variable rate loans suit borrowers with financial flexibility who can absorb potential payment increases. This option may work better if you have a comfortable income buffer and can handle repayment fluctuations, want to make extra repayments to pay off your loan faster, plan to sell the asset or refinance before the loan term ends, or believe interest rates are stable or likely to decrease.

Buyers financing leisure assets like boats or caravans sometimes prefer variable rates because they may sell or upgrade within a few years. Avoiding break costs provides valuable flexibility for those whose plans may change. Understanding your leisure finance repayment strategies helps maximise the benefits of a variable structure.

Split Rate Loans: A Middle Ground

Some lenders offer split rate loans that divide your borrowing between fixed and variable portions. This hybrid approach provides partial protection against rate rises while retaining some flexibility for extra repayments on the variable portion.

Split loans can be a sensible compromise for borrowers who see merit in both structures. However, they add complexity and may not be available from all lenders. Working with a broker who has access to a diverse lending network increases your chances of finding a suitable split product.

How to Choose the Right Rate Structure

Selecting between fixed and variable rates requires honest assessment of your financial position and preferences. Start by evaluating your income stability—borrowers with reliable, predictable income can more confidently manage variable rate uncertainty, while those with irregular earnings may prefer fixed rate security.

Consider your loan term as well. Shorter loans of one to three years experience less cumulative impact from rate changes, making variable structures lower risk. Longer terms amplify the effects of rate movements in either direction. Think also about your plans for the asset, since selling or trading within a few years favours variable rates to avoid potential break costs.

Finally, assess current market conditions. When rates sit at historic lows, locking in a fixed rate protects against likely increases. When rates are elevated, variable loans position you to benefit from potential decreases. Economic commentary and RBA announcements provide useful guidance, though no one can predict future movements with certainty.

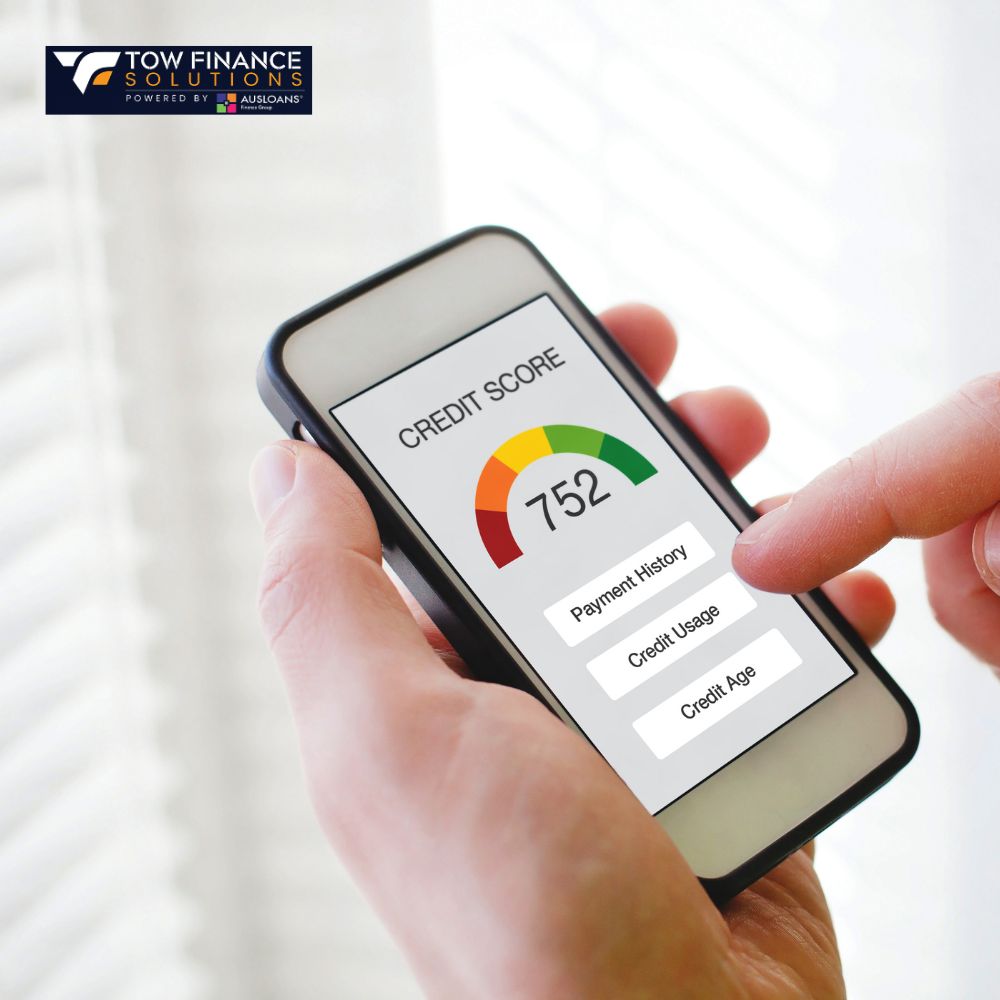

Getting the Best Rate Regardless of Structure

Whether you choose fixed or variable, several factors influence the rate you will receive. Your credit score significantly impacts lender offers, so improving a low credit score before applying can secure better terms. The loan-to-value ratio matters as well—larger deposits or equity typically attract lower rates.

Comparing multiple lenders is essential. Rates vary considerably across the market, and choosing the right loan provider involves more than just headline rates. Consider comparison rates that include fees, lender reputation, and customer service quality.

Watch for hidden fees in loan agreements that can erode the benefit of a low rate. Establishment fees, ongoing account fees, and early exit penalties all affect total loan cost. Using a loan calculator helps you understand the true cost under different scenarios.

Frequently Asked Questions

Can I switch from a fixed rate to a variable rate during my loan?

Switching mid-term is possible but typically incurs break costs on fixed rate loans. These costs can be significant depending on remaining term and rate differentials. Review your loan contract or speak with your lender before making changes.

Are fixed rates always higher than variable rates?

Not always. Fixed rates are priced based on lender predictions of future rate movements. When markets expect rates to fall, fixed rates may be lower than current variable rates. Compare both options at the time of application.

How often do variable rates change?

Variable rates can change at any time, though most adjustments follow RBA cash rate announcements (typically monthly). Lenders may also adjust rates independently based on their funding costs.

Do fixed rate loans allow extra repayments?

Most fixed rate loans permit limited extra repayments, often capped at $5,000 to $10,000 per year. Exceeding these limits may trigger fees. Check your specific loan terms before making additional payments.

Which rate type is better for boat or caravan finance?

It depends on your plans. If you intend to keep the asset long-term and want budget certainty, fixed rates provide security. If you may sell or upgrade within a few years, variable rates offer flexibility without break cost concerns.

What are break costs and how are they calculated?

Break costs compensate lenders when borrowers exit fixed loans early. They are calculated based on the difference between your fixed rate and current market rates, multiplied by remaining term and loan balance. Costs vary significantly by circumstance.

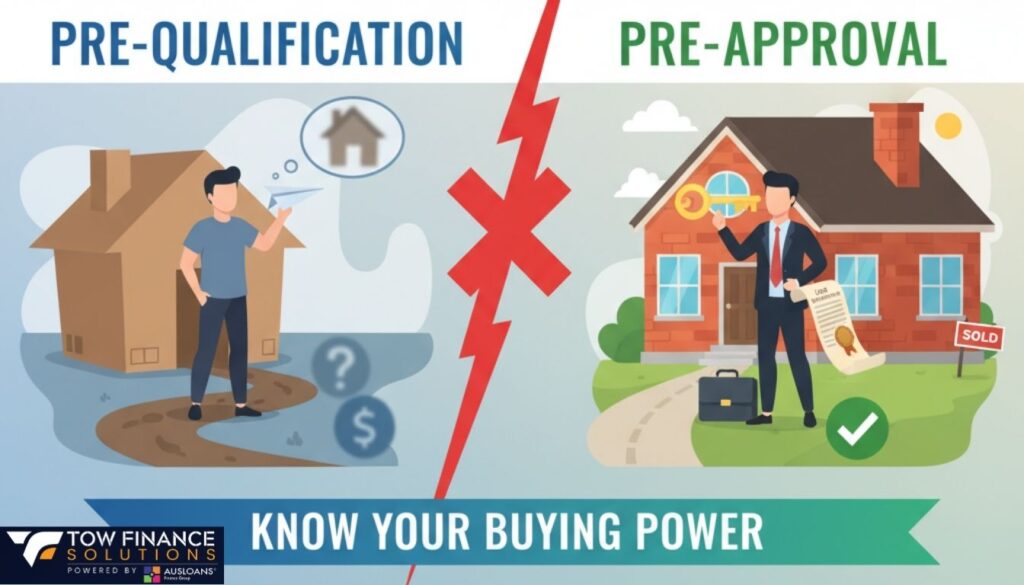

Should I get pre-approval before deciding on a rate type?

Yes. Pre-approved loans confirm your borrowing capacity and often lock in available rates, giving you clarity when comparing fixed and variable options.

How does loan term affect the fixed vs variable decision?

Longer terms increase exposure to rate changes, making fixed rates more protective but also more restrictive. Shorter terms reduce rate volatility impact, making variable rates relatively lower risk.

Can I negotiate my interest rate?

Yes, particularly through a broker with access to multiple lenders. Competition between lenders creates room for negotiation, especially for borrowers with strong credit profiles and solid deposits.

What is the difference between headline rate and comparison rate?

The headline rate is the base interest rate advertised. The comparison rate includes mandatory fees and charges, providing a more accurate picture of total loan cost. Always compare using comparison rates.

Sources

Ready to Find Your Best Rate?

Whether you prefer the certainty of fixed rates or the flexibility of variable, Tow Finance Solutions can match you with the right lender from our panel of 40+ finance providers. Apply Now for a personalised quote or Contact Our Team to discuss your options.